In a strategic move set to transform automotive AI and the semiconductor landscape, Tesla CEO Elon Musk has unveiled a major partnership with Samsung Electronics. The South Korean tech powerhouse will manufacture Tesla’s next-gen AI chips at a new facility under construction in Taylor, Texas. Valued at $16.5 billion, this long-term alliance underscores a growing emphasis on domestic production and innovation in the United States.

The Core of the Agreement

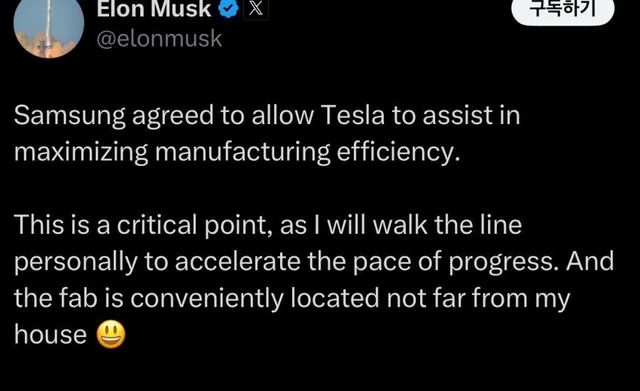

Musk shared the news via a post on X (formerly Twitter), revealing that Samsung’s Texas fab will produce Tesla’s AI6 chip—the sixth-generation neural network processor powering Tesla’s autonomous driving systems and smart car capabilities. “The strategic importance of this is hard to overstate,” Musk wrote, highlighting its scale and impact on Tesla’s future technology roadmap.

Earlier in the day, Samsung disclosed in regulatory filings in South Korea that it had secured a multi-year contract with a major global client. Although the filing stopped short of naming Tesla, Musk’s public statement confirmed the connection.

The deal runs through 2033, securing Tesla a steady supply of high-performance chips for the next eight years. Samsung’s Taylor plant, scheduled to become operational in 2026, will be the key site for AI6 production.

Why Texas Was Chosen

Musk jokingly noted the plant’s proximity to his own residence, saying it’s “conveniently located not far from my house” and hinting that he might “walk the production line personally to accelerate the pace of progress.” His hands-on approach continues to be a signature element of his leadership style.

Beyond convenience, Texas has emerged as a vital player in the tech and manufacturing world. Tesla and SpaceX already have a strong presence in the state, and Samsung is expanding its U.S. footprint in response to shifting geopolitical dynamics and the need for secure supply chains.

Tesla’s Chip Evolution

Tesla’s AI chips are central to its autonomous driving capabilities and in-car computing. Samsung already manufactures the current AI4 chip, and Musk noted that the company has completed the design for its AI5 chip, which will be fabricated by TSMC—Samsung’s primary competitor.

TSMC will initially build AI5 chips at its facility in Taiwan before transferring production to its Arizona plant, further diversifying Tesla’s supply sources and enhancing regional stability in its operations.

This progression—from AI4 to AI5 and ultimately AI6—highlights Tesla’s relentless pursuit of superior performance and smarter, faster autonomous technology.

Financial Response

The market responded swiftly. Samsung Electronics’ stock rose 6.22% on the Seoul exchange, closing at KRW 70,000 ($50.6). Investors reacted positively to the high-profile contract, signaling renewed confidence in Samsung’s chip business.

Tesla, meanwhile, gains access to state-of-the-art manufacturing while aligning with government interests to bolster U.S.-based production. The announcement aligns with broader efforts across industries to reduce reliance on foreign suppliers and encourage domestic growth.

Strategic Value

Musk’s remark on the “strategic importance” of this deal goes well beyond business. It reflects a larger movement to localize critical technologies and build resilience against global disruptions. The choice to manufacture in Texas also supports U.S. goals to reclaim leadership in the semiconductor race.

With increasing investments from countries like China into chip fabrication, American firms are prioritizing local alternatives. Samsung’s Texas initiative dovetails with federal incentives like the CHIPS and Science Act, a major legislative push to expand domestic semiconductor capabilities.

What’s Next for Tesla AI?

Tesla’s advancement in AI and autonomous systems relies heavily on its chip technology. The AI6 chip, destined for Samsung’s Texas line, is expected to be central to Tesla’s future vehicles—offering increased performance, faster processing, and more robust machine learning capabilities.

Musk indicated that Tesla will play an active role in enhancing efficiency at the Samsung facility. In a follow-up post, he said Samsung agreed to let Tesla assist with improving manufacturing processes, hinting at collaborative innovation beyond just chip design.

This could herald joint breakthroughs in how AI chips are built, tested, and integrated into vehicle systems. Combining Tesla’s software expertise with Samsung’s hardware infrastructure may create new benchmarks across industries.

The Bigger Picture

The Tesla-Samsung partnership represents more than a massive deal—it is a strategic alignment that could influence how next-generation technologies are developed and delivered. As operations ramp up toward 2026, both companies are poised to play leading roles in reshaping mobility and artificial intelligence.

For Musk, this move reinforces a vision that Tesla isn’t just a car company. It’s an engineering-led force pushing the boundaries of machine learning, autonomy, and sustainable innovation. Samsung’s role gives it a front-row seat to this transformation.